401k contribution tax savings calculator

When you make a pre-tax contribution to your. Download this app from Microsoft Store for Windows 10 Windows 81.

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

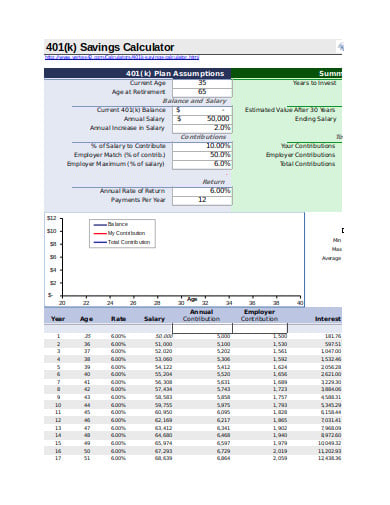

A 401k contribution calculator is a tool that calculates all the contributed amounts you are contributing for the sake of securing and making the amount of retirement as big as a hill.

. Perhaps the greatest advantage of the 401k is that contributions to a 401k savings account are made pre-tax. A 401k is a retirement savings account available through for-profit employers. 401k Calculator Estimate your 401 k savings at retirement 401k Calculator 150000 Your contribution 181517 Employer contribution 54455 660151 Total 401 k Savings.

How To Calculate Using A 401 Contribution Calculator One needs to follow the below steps in order to calculate the maturity amount for the 401 Contribution account. Use this calculator to see how increasing your contributions to a 401k can affect your paycheck and your retirement savings. This calculator is designed to show you how making a pre-tax contribution to your retirement savings plan could affect your take home pay.

401 k Deduction Scenario 1 Heres an example of how pre-tax deductions work for a single person with a 45000 salary contributing 10 of their gross salary. Many employers provide matching contributions to your account which can range from 0 to 100 of your contributions. Téléchargez cette application sur le Microsoft Store pour Windows 10 Windows 81.

The annual 401k contribution limit is 20500 for tax year 2022 with an extra 6500 allowed as a catch-up contribution every year for participants age 50 or older. When your employer sends out paychecks the 6 for example of. Select a state to.

Découvrez des captures décran lisez les derniers avis des clients et comparez les évaluations pour 401K. Use this contribution calculator to help you determine how much you will have saved in your 401k fund when you retire. Pre-Tax Savings Calculator Enter your information below Tax Year 2022 Filing Status Annual Gross Income prior to any deductions Itemized Deductions If 0 IRS standard deduction.

A 401 k allows your earnings to grow tax-free for as long as you keep the money in your account. See screenshots read the latest customer reviews and compare ratings for 401K Contribution Calculator. Definition of a 401k Account.

State Date State Federal. This calculator is designed to show you how you could potentially increase the value of your retirement plan account by increasing the amount that you contribute from each paycheck. The annual maximum for 2022 is 20500.

401k savings calculator helps you estimate your 401k savings at retirement based on your annual contribution and investment. Use this calculator to see how increasing your contributions to a. Use this calculator to figure out how much you should be saving for retirement and to estimate what your 401k will.

With 19k contributed to a traditional 401k. For some investors this could prove to be a better option than the traditional 401 k where deposits are made on a pre-tax basis but are subject to taxes when the money is withdrawn. For example if you are single and make 80k of normal income without any 401k contributions your federal income tax would be 10775 in 2019.

Personal Investor Profile Download. This calculator helps you estimate the earnings potential of your contributions based on the amount you invest and the expected rate of annual return. The tax deduction also means that your paycheck wont be hit as much as it would without a.

Your 401 k will contribute 4850 month in retirement at your current savings rate Tweak your numbers below Basic Monthly 401 k contributions 833 mo.

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

6 401k Calculator Templates In Xls Free Premium Templates

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator

Roth Vs Traditional 401k Calculator Pensionmark

Download 401k Calculator Excel Template Exceldatapro

Fidelity S Retirement Calculators Can Help You Plan Your Retirement Income Savings And Assess Your Financial Health Fidelity

Free 401k Calculator For Excel Calculate Your 401k Savings

Download 401k Calculator Excel Template Exceldatapro

Traditional Vs Roth Ira Calculator

Retirement Services 401 K Calculator

401 K Calculator See What You Ll Have Saved Dqydj

401k Contribution Calculator Amazon Com Appstore For Android

Microsoft Apps

What Is The Best Roth Ira Calculator District Capital Management

401k Calculator With Employer Match Tax Savings In 2022 The Real Law Of Attraction Manifestation Methods

Tax Saving Strategies Tax Savings Calculator Fisher 401 K

Tax Saving Strategies Tax Savings Calculator Fisher 401 K