44+ calculate debt to income ratio for mortgage

Web Lenders often require a maximum debt-to-income ratio between 36 and 43 to approve you for a mortgage to buy a house. Ad Calculate Your Payment with 0 Down.

Debt To Income Ratio Formula Calculator Excel Template

Web Your debt-to-credit ratio is the amount of credit youre using on your credit cards relative to your credit limits at a given time.

. To get the back-end ratio add up your other debts along with your housing expenses. But with a bi-weekly. Web A good debt-to-income ratio is often between 36 and 43 but lower is usually better when it comes to applying for a mortgage.

Compare up-to-date mortgage rates and find one thats right for you. Web Your front-end or household ratio would be 1800 7000 026 or 26. Ad See how much house you can afford.

Some lenders may accept a debt-to-income ratio of. Web Debt-to-income ratio DTI is the ratio of total debt payments divided by gross income before tax expressed as a percentage usually on either a monthly or annual basis. Web Step 1 - Gross Annual Income Did You Know.

Web This video breaks down the meaning of your debt-to-income ratio how to calculate it and the required debt-to-income ratio mortgage lenders are looking for. Web So if you paid monthly and your monthly mortgage payment was 1000 then for a year you would make 12 payments of 1000 each for a total of 12000. Free Shipping on Qualified Orders.

Web The 2836 rule is an addendum to the 28 rule. Ad Shop Devices Apparel Books Music More. In this formula total monthly debt.

Its an important factor in your credit. Youll see there are slots for mortgage. Your lender will also look at your total debts which.

28 of your income will go to your mortgage payment and 36 to all your other household debt. Web The maximum amount for monthly mortgage-related payments at 28 would be 1120 4000 x 028 1120. Veterans Use This Powerful VA Loan Benefit For Your Next Home.

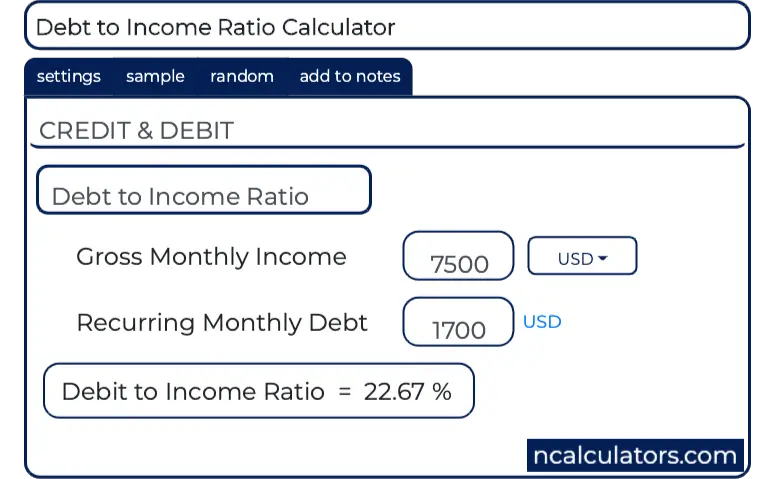

Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment. Mortgage professionals use 2 main ratios to decide if borrowers can afford to buy a home. Total monthly debt paymentsGross monthly income x 100 Debt-to-income ratio.

Gross Debt Service GDS. Web 36 41. Web Calculate How to do a debt-to-income ratio check Step 1 Enter all your personal loan expenses into our calculator.

Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment. Your debt-to-income DTI ratio and credit history are two important financial health factors lenders consider when determining if they will lend. Ratios in this range show lenders that you have reasonable amounts of debt and still have enough income to cover the cost of a mortgage should.

Web Debt-to-Income Ratio Calculator. Estimate your monthly mortgage payment. Web Heres how the debt-to-income ratio is calculated.

Heres a simple three-step process you can follow to find your debt-to. Web All you really have to do is whip out your iPhone and input a few easy numbers into the calculator app.

Phan Tich Trong Big Data Pdf

Debt Ratio And Debt To Income Ratio

Debt To Income Ratio Calculator Officetemplates Net

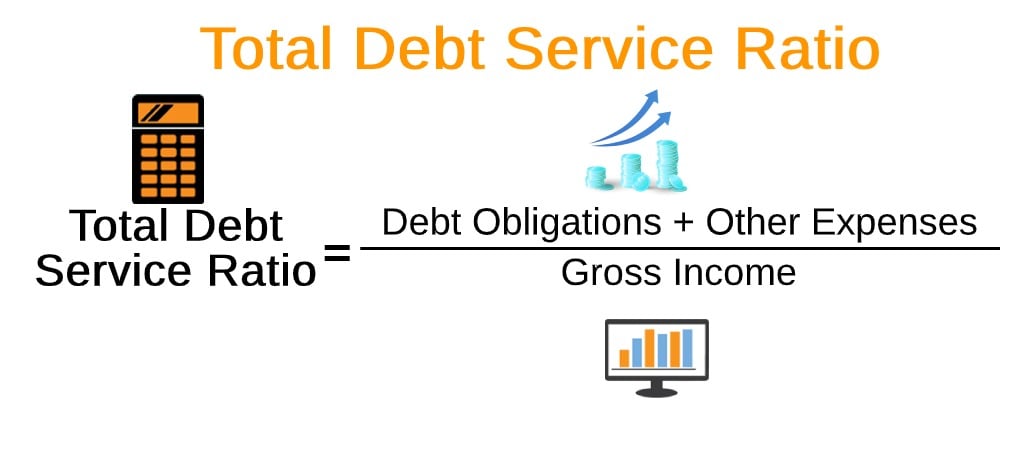

Total Debt Service Ratio Explanation And Examples With Excel Template

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

How To Calculate Your Debt To Income Ratio For A Mortgage

Calculate Your Debt To Income Ratio Wells Fargo

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

List Of Top Personal Loan Providers In Barra Best Personal Loans Online Justdial

List Of Top Personal Loan Providers In Bhukum Best Personal Loans Online Justdial

Debt To Income Ratio Calculator Nerdwallet

Debt To Income Ratio Crb Kenya

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

Rc5v0wed3oeqem

Debt To Income Ratio Calculator

Debt To Income Ratio Calculator Nerdwallet

Calculating Debt To Income Ratio